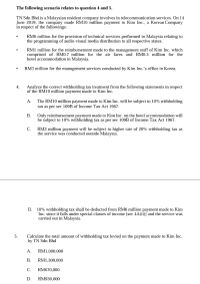

malaysian taxation question and answer

Malaysian taxation question and answer nov 2019 question and answer part 1. A tax that takes a larger percentage from high-income earners than it does from low-income earners is called.

Answered The Following Scenario Relates To Bartleby

They cannot be published in any form.

. A copy of the MAP request should also be submitted to. Revenue receipt - taxable b sums. Ranjit a Malaysian citizen and employed as a senior lecturer with a public university in Selangor Malaysia.

TAX RATES AND ALLOWANCES The following tax rates allowances and values are to be used in answering the questions. May I pay less than the originally agreed upon monthly installment amount. Do NOT open this question paper until instructed by the supervisor.

The Competent Authority Department of International Taxation Inland Revenue Board of Malaysia. Malaysian Taxation Industrial Building Allowance IBA QBE Question and Answer. Seribayu Enterprise is a partnership business owned by Seri and Bayu engaged in supplying fresh flowers to customers in Kuala Lumpur and Selangor.

An individual who is declared bankrupt is not allowed to manage his her own assets as provisioned in Section 8 of the Insolvency Act 1967 because all assets and. Partnership Malaysian Taxation Question and Answer 18 Jan 2021. 1 The correct answer is.

Past Year Question - MIA Qualifying Examination - September 2019 Taxation Syllabus Taxation_Syllabus pdf Download PDF 207KB Taxation Question - September 2019. Kanowit timber sdn bhd v kphdn. Question 7 i taxability of compensation received a sums received in respect of outgoings and expenses case law.

Income tax rates Resident individuals Chargeable income Rate. See the answer Objective. All question papers and solutions are the copyright of ACCA and can only be used for classroom and student use in preparation for their ACCA exams.

1 The system should predict the amount of income tax payable with reasonable accuracy and certainty. During reading and planning time only the question paper may be. What is the cost of participating in AKPKs DMP.

Taxation is one of the mode used by the government to finance their expenditure by imposing charges on citizens and corporate entities. Income tax is collected on all types of income except. Monthly repayments that are less than the originally agreed upon monthly.

Business Taxation Multiple Choice Questions. Rates of tax and tables are printed on pages 24. INCOME TAX ACT 1961.

1 mark iii State and explain the minimum amount of estimate it must furnish. 1 and 2 only Statements 1 and 2 are true. No you may not.

Customers will be required to confidently deal with credit counsellor face-to-face on their debt restructuring plan. There is no fee for a. 1 mark ii State and explain the date by which it should furnish its initial tax estimate.

Consider the following situation. To discuss on the mechanism and legislation of Malaysian taxation system for individual taxpayer In the year 2021 the government of Malaysia has.

Acca F6 Tx Mys Taxation Malaysia Revision Kit Question Bank Softcopy Hobbies Toys Books Magazines Textbooks On Carousell

I M Very Worried Chinatown Community Braces For 30 Day Orange Line Shutdown With Many Unanswered Questions The Boston Globe

Question Regarding Tax Residence Status For Tax Clearance R Malaysia

Paper F6 Mys Taxation Malaysia Specimen Exam Applicable From December Fundamentals Level Skills Module Pdf Free Download

Oxford Fajar Companion Website

Pdf Mae2013 Malaysian Taxation And Zakat Administration Orkedlili Binti Zahari Academia Edu

Paper F6 Mys Taxation Malaysia Tuesday 4 June Fundamentals Level Skills Module The Association Of Chartered Certified Accountants Pdf Free Download

Property Tax In Malaysia And South Africa A Question Of Assessment Capacity And Quality Assurance Semantic Scholar

Withholding Tax Malaysia 2022 Jan 28 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

.jpg)

Mco 3 0 10 Key Tax Questions Answered S Saravana Kumar And Nurul Imani Hamzah Malay Mail

Solution Taxation Exam Answer N Question With Explaination Studypool

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Accountant Interview Questions

Frequently Asked Questions Income Tax In Malaysia

Malaysia History Flag Map Population Language Religion Facts Britannica

Pros And Cons For The U S Of Flat Vs Progressive Taxes Toughnickel

Handbook Of Malaysian Taxation Ii Dec2020 Mac2021 2 1 Pages 201 208 Flip Pdf Download Fliphtml5

0 Response to "malaysian taxation question and answer"

Post a Comment